North America vs Europe: Economic Updates 2025

Stay informed with the most recent economic trends and forecasts for North America and Europe in 2025. Here’s what’s happening now—and what it means for your business or investment strategy.

🇺🇸 North America

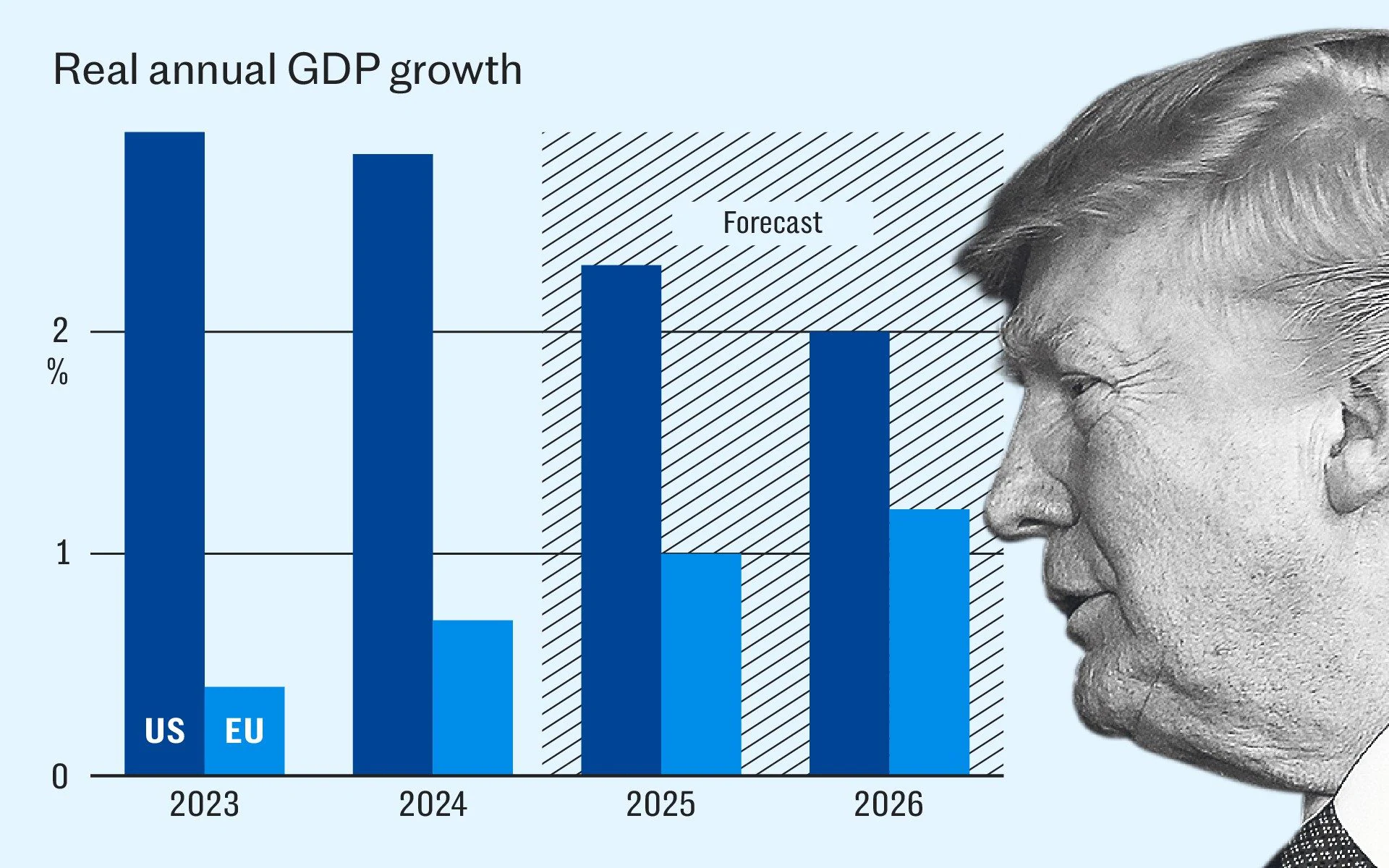

Q2 Growth Outlook Weakening

- EY projects U.S. GDP growth at 1.5% for 2025, with a 35% chance of recession.

- University of Michigan sees U.S. growth slowing to 0.8% by Q4 2025.

- S&P Global expects 1.1% real GDP growth by Q4 2025.

Tariff Pressures & Inflation

- Tariff uncertainty is raising costs and could push core PCE inflation to 2.8–3.0%.

- Conference Board reports ongoing tariffs may reduce GDP and lead to potential Fed rate cuts.

Labor Market & Housing

- U.S. unemployment remains around 4.2–4.4%.

- Housing starts are expected to decline through 2025, recovering into 2026–27.

Regional Highlight: Arizona

Arizona is seeing a record-breaking $31 billion manufacturing boom, creating about 24,000 jobs.

🇪🇺 Europe

GDP Growth Outlook

- EU growth forecast: 1.1% for EU, 0.9% for eurozone in 2025.

- EY expects eurozone growth to hit 1.3% in 2025, up from 0.7% in 2024.

- Conference Board projects 0.9% in 2025, rising to 1.3% in 2026.

Inflation & Monetary Policy

- Eurozone inflation is likely to average 2.1% in 2025, moving toward the ECB’s 2% target.

- ECB expected to cut rates in late 2025 as disinflation continues.

Risks: Trade & Climate

- New U.S. tariff threats could cost the eurozone up to €2 trillion in trade.

- Extreme weather events could slash the eurozone’s GDP by 5% in the next five years.

Structural Developments

- EU’s VAT in the Digital Age e-invoicing reforms began in April 2025.

- The Readiness 2030 defense initiative is investing €800 billion to boost European strategic autonomy.

📌 Key Takeaways

| Region | Growth | Inflation | Risks |

|---|---|---|---|

| North America | ~1–1.5% in 2025, mid-term rebound | Core PCE ~2.8–3.0% | Tariffs, slowdown in jobs/housing |

| Europe | ~0.9–1.3% in 2025, modest recovery | CPI ~2%, disinflating | Trade tensions, climate shocks |

✅ Strategic Implications

- Businesses: Adapt supply chains, watch Fed and ECB policy shifts, and diversify against trade barriers.

- Investors: Hedge currency risks, track energy and sustainability sectors, and prepare for climate-related impacts.

🔗 Related Reading

👉 For more updates, subscribe to our newsletter and stay ahead with the latest economic forecasts for North America and Europe.