Intel Agrees to Sell U.S. a 10% Stake in Its Business – What It Means for the Future of Tech and National Security

In a major move shaking up the global technology landscape, Intel has agreed to sell a 10% stake in its business to the U.S. government. This deal is not just about finance — it reflects the growing importance of semiconductors, national security, and America’s push to regain leadership in chip manufacturing.

Why Is the U.S. Buying a Stake in Intel?

Over the past few years, the U.S. has been increasingly concerned about its reliance on foreign chip manufacturers, especially in Asia. With China, Taiwan, and South Korea dominating semiconductor production, the U.S. has been seeking ways to bring more chip-making capacity back home.

By securing a stake in Intel, the largest U.S.-based semiconductor company, the government is:

- Strengthening domestic production of advanced chips.

- Reducing dependence on foreign supply chains that could be disrupted during geopolitical conflicts.

- Supporting innovation in AI, defense technology, and 5G networks.

The Deal at a Glance

- Stake Size: 10% ownership in Intel.

- Buyer: U.S. government (through a strategic investment program).

- Goal: Boost domestic chip production and safeguard critical U.S. technology.

This move comes at a time when global competition in the semiconductor sector is heating up, with both China and the European Union investing heavily in chip independence.

How This Impacts the Semiconductor Industry

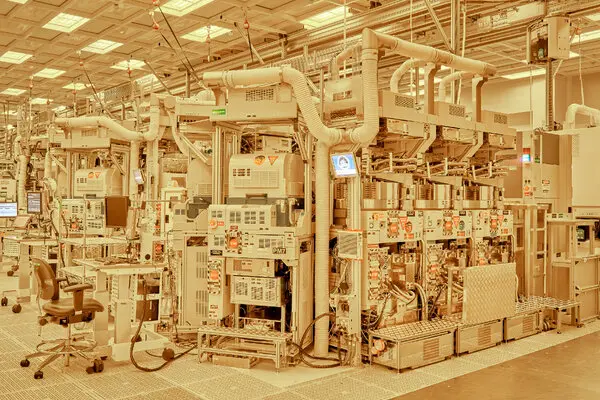

Intel has been struggling to keep up with competitors like TSMC (Taiwan Semiconductor Manufacturing Company) and Samsung, both of which have taken the lead in advanced chipmaking. With U.S. backing, Intel gains:

- Financial security to expand chip plants in America.

- Government support for R&D and manufacturing facilities.

- A stronger position to compete in AI, defense, and high-performance computing.

At the same time, this deal will likely encourage other U.S. tech companies to seek public-private partnerships to accelerate growth.

Why This Matters for Everyday Consumers

You might wonder — how does this deal affect regular people? The answer lies in technology we use daily. Chips power everything from:

- Smartphones and laptops

- Electric vehicles

- Medical equipment

- Defense systems

By boosting Intel’s capacity, the U.S. aims to make chips more affordable, available, and secure. This could reduce shortages like the ones seen during the pandemic that disrupted car manufacturing and electronics production.

The National Security Angle

This isn’t just about business — it’s about national security. Chips are the backbone of modern military systems, satellites, and communication networks. With rising tensions between the U.S. and China, the government is ensuring that critical chip technologies remain in safe hands.

Global Reactions

- China: Likely to see this as a direct challenge to its tech ambitions.

- Europe: May accelerate its own semiconductor funding programs.

- Tech Companies: Could benefit from a more secure and predictable chip supply.

Final Thoughts

The U.S. buying a 10% stake in Intel marks a turning point in technology and geopolitics. It’s a clear signal that semiconductors are no longer just a business issue — they are a matter of strategic importance.

For Intel, this deal brings much-needed support to compete with global rivals. For the U.S., it’s a step toward securing its technological future. And for consumers, it could mean a more stable supply of the chips that power our modern lives.